All Episodes - Retire With Clarity

Every day of our adult lives, we make financial decisions that are going to affect our ability — or inability — to retire. And most of us don’t even realize it! How often do you take time to look at the financial “big picture” and think about how your choices might affect your tomorrow? Planning for retirement can be confusing, to say the least. And that’s why we’re happy to tell you about our show, called Retire with Clarity. http://www.retirewithclarity.com

View Podcast Details23 Episodes

Will you want to hang with your spouse 24/7 when retired?

Long marriages a successful in part because we spend time at work! What happens when you no longer work and instead are with your spouse 24/7? This episode is about practical things you can do to prepare your relationship with your significant other. Hint: One solution is “practicing for retirement" For more information, please visit www.retirewithclarity.com

The Five key areas the Money Master Plan addresses (Part 3 of 3)

People have questions about retirement. One of those questions is “what other questions should I be asking”” The easiest way to discuss this is in the context of the Money Master Plan Roadmap. Stonebridge Financial Group’s process is called Money Master Plan. In this episode we discuss the 5 key areas the MMP addresses. 1. Income Distribution Plan 2. Investment Plan 3. Tax Plan 4. Healthcare Plan 5. Legacy Plan Learn more at http:www.retirewithclarity.com

The Five key areas the Money Master Plan addresses (Part 2 of 3)

People have questions about retirement. One of those questions is “what other questions should I be asking”” The easiest way to discuss this is in the context of the Money Master Plan Roadmap. Stonebridge Financial Group’s process is called Money Master Plan. In this episode we discuss the 5 key areas the MMP addresses. 1. Income Distribution Plan 2. Investment Plan 3. Tax Plan 4. Healthcare Plan 5. Legacy Plan Learn more at http:www.retirewithclarity.com

The Five key areas the Money Master Plan addresses (Part 1 of 3)

People have questions about retirement. One of those questions is “what other questions should I be asking”” The easiest way to discuss this is in the context of the Money Master Plan Roadmap. Stonebridge Financial Group’s process is called Money Master Plan. In this episode we discuss the 5 key areas the MMP addresses. 1. Income Distribution Plan 2. Investment Plan 3. Tax Plan 4. Healthcare Plan 5. Legacy Plan Learn more at http:www.retirewithclarity.com

True or False? People underestimate how long their retirement money needs to last.

In this episode, we discuss if people underestimate how long their retirement money needs to last. For more information, visit www.retirewithclarity.com

Why 62% of Americans do not have a financial advisor

In this episode, we look at a study that shows 62% of Americans do not have a financial advisor. We discuss the reasons why. For more information, please visit www.retirewithclarity.com.

What is on your bucket list?

In this episode, we ask what is on your bucket list. How encouraging yourself to expand your bucket list can improve your love of life and retirement. For more information, please visit www.retirewithclarity.com

Safe Money vs Risk Money

In this episode, we discuss safe money vs. risk money - which should you have and how much? For more information, please visit www.retirewithclarity.com

Social Security Experts Costing People Money

This episode is about why the so called Social Security experts are actually costing retirees money. We also talk about the important survivors benefits in Social Security. For more information, please visit www.retirewithclarity.com

Tax Inefficiencies for Retirees

In this episode, we talk about tax problems that retiree’s have PLUS tax inefficiencies that most advisors are overlooking for retirees. For more information, please visit www.retirewithclarity.com

People ask about Social Security.

People ask about Social Security. We discuss what you need to know about Social Security claiming in this episode including why it might not be as simple as you think! For more information, please visit www.retirewithclarity.com

Common questions about retirement

On this episode, we discuss common questions families ask in our office about retirement. For more information, please visit www.retirewithclarity.com

What does March Madness tell us about retirement?

Find out the answer to this question and many more on this week's show! For more information, please visit www.retirewithclarity.com

What you know that Bill Gates doesn’t (about retirement)

Listen in to last weeks show! On this weeks show… most parent don’t regret this decision, even though they should. We’ll tell you what it is. Considering the recent tax cuts, is now a good time to do a Roth conversion? Plus, what you know that Bill Gates doesn’t. For more information, please visit www.retirewithclarity.com

How to not withdraw money during a down market

Here’s the recording of last week’s show! See below for the topics discussed: 7:51 How taxes differ when you stop working. 15:40 Happy birthday to the ROTH IRA! 19:08 What are you doing to help the longevity of your money? 27:55 Is a fixed index annuity a good alternative to bonds? 34:30 Do you have collectables included as part of your retirement plan? 39:22 What is the future service relationship you will have with your financial advisor? 43:40 How to not withdraw money during a down market. For more information, please visit www.retirewithclarity.com

Three ways to protect yourself during the market cycle

Here’s the recording of last week’s show! See below for the topics discussed during the show: 3:00 Three ways to protect yourself during the market cycle. 15:33 Upcoming Taxes in Retirement workshop. 22:00 Is phased retirement the right path for you? 26:25 How risky are stocks when it comes to your retirement plan? 35:35 Can the private sector save the health care system? For more information, please visit www.retirewithclarity.com

Tips for the recent tax changes & more!

(Skip ahead to the times listed for the topics below) 2:26 COLA and why it is so important. 5:34 Why most people don't want to retire. 12:44 Market cycle and your retirement plan. 17:25 Tax tips based on the recent tax changes for retirees. 30:28 How to face the idea of "not working." 44:45 Health benefits of retiring earlier rather than later. For more information, please visit www.retirewithclarity.com

How to convert your retirement accounts into retirement income

Skip ahead to the times listed for the topics below: 4:10 Setting goals: Key to enjoying your money long term. 5:40 How to give yourself a raise in your plan. 14:12 What a Navy Seal says about procrastinating when it comes to retirement planning. 19:42 What to do with a 401k from a previous employer. 25:41 How to get on the same page with your spouse when it comes to major financial issues. 30:14 How to not underestimate your longevity needs. 37:23 How to convert your retirement accounts into retirement income. 41:00 What was the top financial goal for 2017? For more information, please visit www.retirewithclarity.com

One big flaw in DIY retirement planning

Skip ahead to the times listed for the topics below: 4:20 The benefits of checking in with your retirement plan. 13:00 If you experienced amazing gains in 2017 – here’s what to be aware of in 2018 and beyond. 17:08 How often do spouses agree on when to claim social security? 25:42 Navigating if you should help your children or fund your retirement. 30:55 Cost of stable income in retirement. 38:12 Why some people never really retire and why they couldn’t be happier. 44:27 One big flaw in DIY retirement planning. For more information, please visit www.retirewithclarity.com

The most revealing question a financial planner should ask

Skip ahead to the times listed for the topics below: 3:23 Having a disciplined approach to planning vs chasing returns 5:38 How the new tax laws could affect you 12:33 Making sure you and your spouse are on the same retirement page 16:30 Fears people have about financial planning 25:33 What to do if offered early retirement 29:40 Some people's ideal retirement 37:16 The most revealing question a financial planner should ask 41:58 How to know how much you need to retire

Would Social Security Admin lead you astray?

Highlights from this week's show: 3:25 Your social security claiming decisions in relationship to a possible market decline. 6:45 Are your IRA beneficiaries set up correctly for your personal situation? 12:36 What can you do about hidden fees? 25:19 What is a tax bomb? How can you avoid it? 28:45 Is social security administration steering you wrong? 37:40 Should you open a line of credit before you retire? 41:24 What does George Foreman think about the retirement lifestyle? For more information, please visit www.retirewithclarity.com

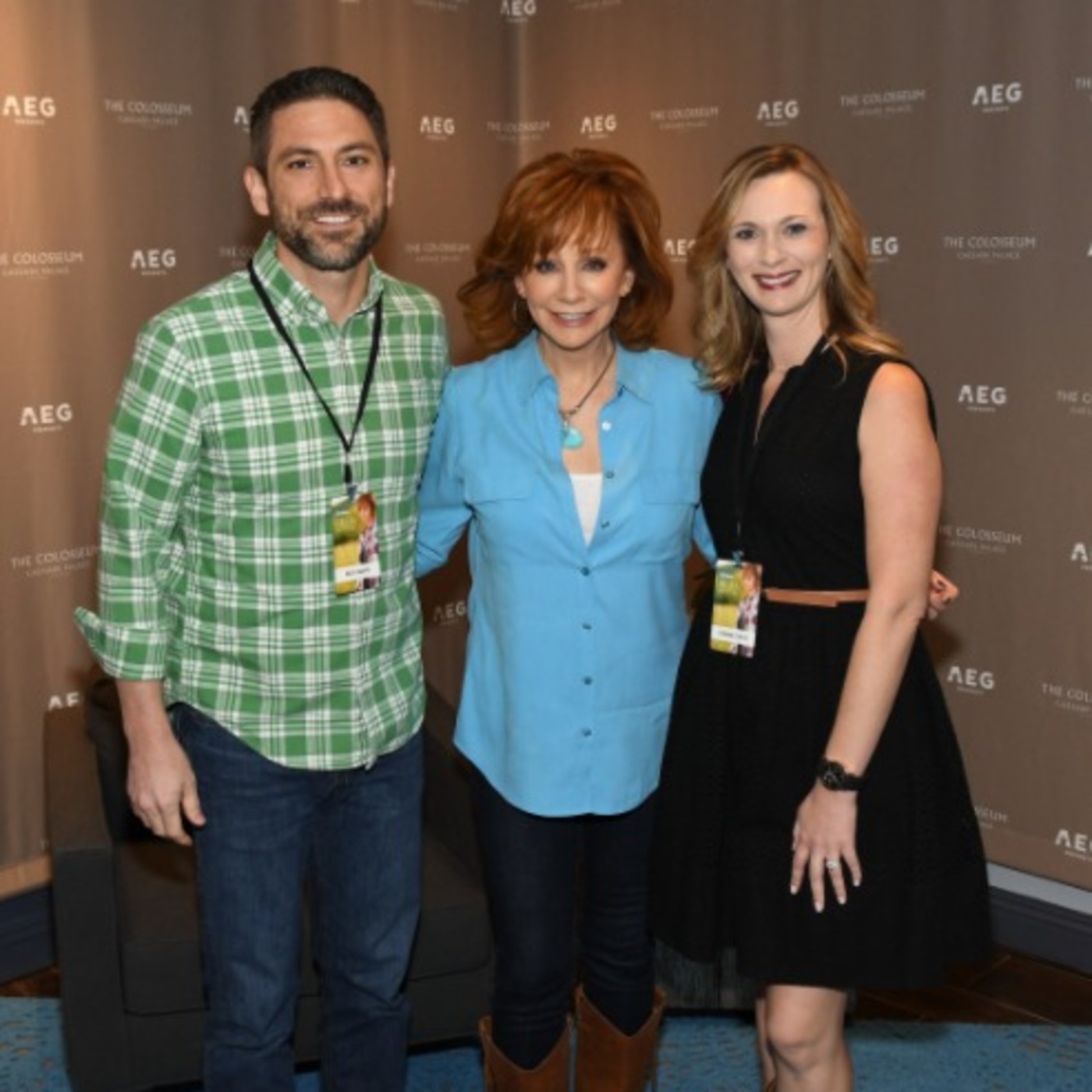

Reba McEntire episode. Hear what Reba thinks about retirement!

What are Reba McEntire's morning rituals like? Latest favorite Scripture? Favorite song on her new album? Listen in for more!