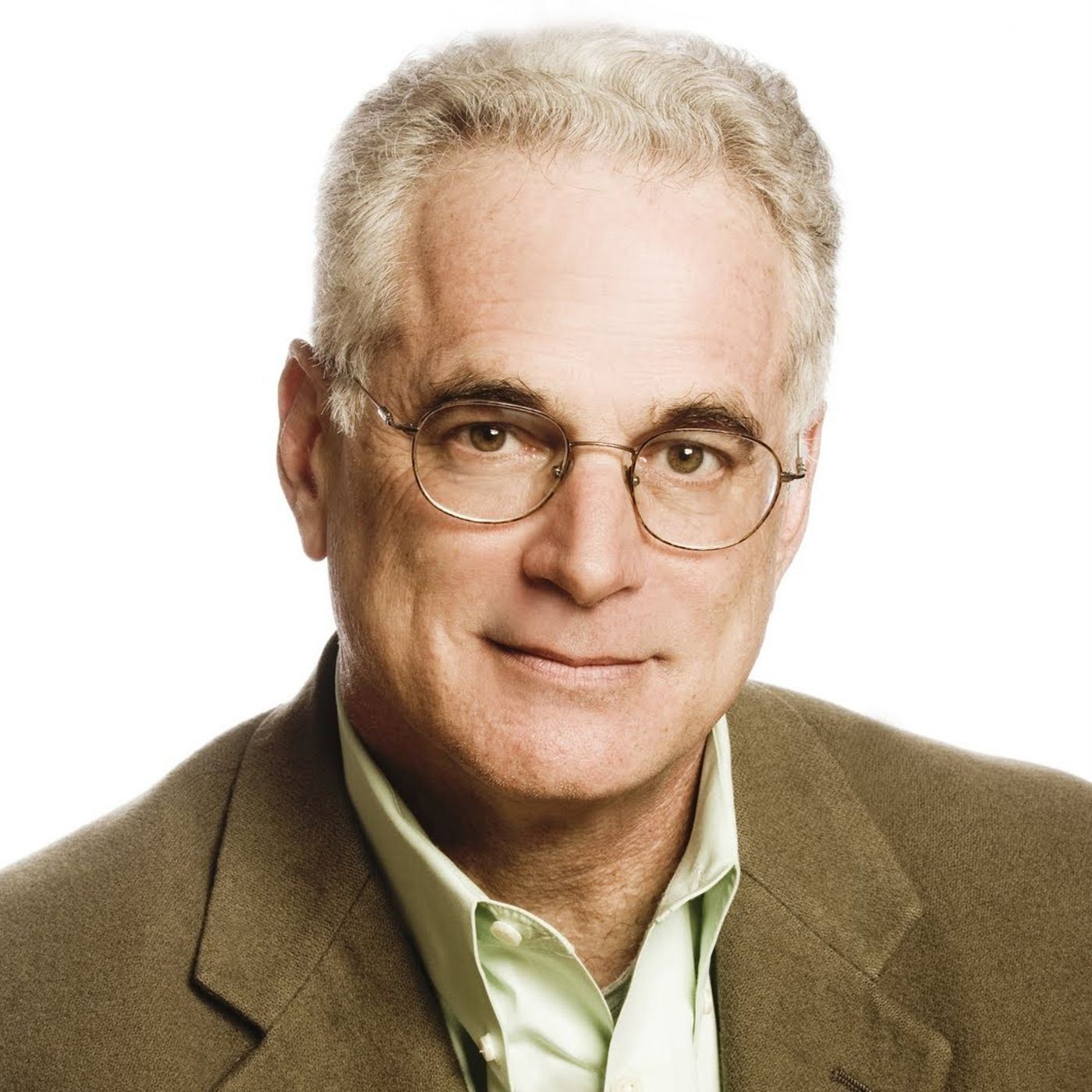

All Episodes - The Steve Pomeranz Show

The Steve Pomeranz Show is a weekly financial radio show featuring nationally-acclaimed financial expert and host, Steve Pomeranz. The show educates and protects listeners with money advice covering the entire financial spectrum- from money rebates and rip-offs, to smart shopping, wise investing and retirement financial issues.

View Podcast Details967 Episodes

Will February's Market Volatility Derail The Rest Of The Year?

January 2018’s 5.6% rise in the S&P 500 suggests shares will likely rise for the rest of 2018. Will February's rout cancel this old adage?

Now You Can Earn Royalties From Your Favorite Music Artist

Royalty rights is a rising alternative asset class that could help diversify your portfolio. It has its risks, so proceed with caution.

Considering Diversifying Into Real Estate? Know The Risks First

Real estate is a great way to diversify your investments provided you know how to calculate your real rate of return and are aware of the risks.

What Buffett's Real Estate Investments Will Teach You About Investing

With market volatility rising again, it's time to go back to the master. Buffett's 2013 Annual Report, is exactly what the doctor ordered.

12 Smart Financial Moves For The New Year: Part II

Get financially ahead in 2018 with 12 smart financial moves that help you save money, shore up your finances, and protect your identity.

12 Smart Financial Moves For The New Year: Part I

Get financially ahead in 2018 with 12 smart financial moves that help you save money, shore up your finances, and protect your identity.

Surprising Moves To Improve Your Credit Score And Change Your Life

Significantly improve your credit score and save hundreds of thousands of dollars in excess interest and fees over a lifetime.

Don’t Let The New Tax Law Keep You From Buying Your Next Home

Don’t let the new tax law keep you from buying a new home. Instead, focus on low mortgage interest rates and the wonderful benefits of home ownership.

How Offshore Tax Evasion Schemes Are Hurting Us All

Find out how billions of dollars of potential tax revenue are being diverted through offshore shell companies and how it's hurting us all.

Trying To Change The World? Here's How To Put Your Money Where Your Mouth Is

Want to change the world for the better? Like the idea of giving back and doing good? Get your investments to help with the heavy lifting.

Are You Protected From The Growing Epidemic Of Elder Financial Abuse?

1 in 10 seniors (aprox 5 million) are victims of elder abuse & neglect every year. It's a major issue, so here's how to protect yourself & those you love.

Don't Let Unfounded Fears Stop You From Buying A Home

Don’t psych yourself out of the home-buying market due to unfounded fears. Instead, overcome those fears and become the proud owner of your first home.

Now Is A Good Time To Find Your Dream Employee

With unemployment at an 18-year low, find out how your company can hire dream employees in a tight labor market.

Financial Wisdom In 41 Savvy Tweets

Definitely read that heavy tome on investments and financial planning. But if you’re in a hurry, get your financial smarts through 41 witty tweets instead.

Looking To Buy Or Sell Your Home? 2018 Might Just Be The Year To Do It!

Real estate prices have risen steadily over the past few years. Will the trend continue? See what’s in store for the 2018 housing market.

Buying Your Next Home? Watch Out For Those Hidden Costs!!

People base affordability on down-payment, mortgage, taxes, and closing costs. But there are actually more expenses you should budget for.

Don't Fall Victim To These Real Estate Scams

Real estate scams are on the rise as people get more comfortable transacting online, sight unseen. Protect yourself with these simple precautions.

Do You Hold Too Much Of Your Company’s Stock?

Employees have made millions holding company stock. What we don’t hear is how employees have lost millions holding company stock. So where’s the balance?

The Secret To Successfully Flipping Homes

Flipping homes can be profitable, but it takes a lot to get it right. You could end up with a renovated home that no one wants to buy.

The Surprising Ways Self Driving Cars Will Change Our World

If self driving cars become a reality in ten or twenty years, they will change the entire real estate landscape in ways few of us can imagine.

Don't Let Your Loved One Become A Victim Of Elder Abuse

Could You Or Someone You Know Be A Victim Of Elder Abuse?Financial crimes against the elderly are nothing new. Older people are often targeted by children, close family, friends and scam artists of various types. The elderly are also vulnerable to cyber-crime, hacking and identity theft. I believe it is important to warn my readers to be aware of crimes against the elderly and convey this on to people who could be targets.A recent article I came across in the New York Times by Constance Gustke also highlights this topic. The article starts out with a story about an 84-year old woman, Maria, who was approached by a longtime friend, a younger woman, for a $500,000 loan to help get her boyfriend back on his feet. Maria decided to help because she had lent money to her young friend before and it had always been paid back. Without consulting a professional, she handed over $500,000 but never got back a cent even after a judgment against the couple! Maria now deeply regrets her generosity. At 84, she’s lost her retirement nest egg and lives near the edge of poverty. Thankfully, Maria owns her home and receives social security so she will do okay, but that’s no consolation!Maria says she treated this “friend” like a daughter. The friend, meanwhile, won her trust and said she’d always be there to take care of Maria and then, sadly, sold her out.It’s a sad story but what’s even sadder is that this is just the tip of the iceberg. Financial crimes against elders take a toll on their lives and pocketbooks every day. Sadly, trusted caregivers children, friends, and relatives are often most at fault.Older adults are vulnerable targets because they usually have a fair amount of money saved, are typically debt-free, and own their homes. As old age takes a toll on memory loss, weakened motor skills such as the inability to sign checks after a stroke, dementia, Alzheimer’s, etc., the elderly become increasingly incapable of protecting themselves against fraud and unwittingly become easy targets from people they’d never suspect—trusted friends, close family members, or caretakers who get greedy, especially when they know the elder has no recourse to anyone else for day-to-day survival.Elderly abuse has no boundaries. It happens across social strata. For example, in a recent high profile case, millionaire socialite Brooke Astor was robbed by her son, Anthony Marshall, of tens of millions of dollars after getting power of attorney over his mother’s assets.In another prominent case, noted actor Mickey Rooney was robbed by his stepson, who began draining millions from Mickey’s accounts after purchasing hydrocodone without a prescription, receiving power of attorney, and leaving the actor broke and in debt when he died. In testimony to Congress before he died, Mr. Rooney urged abused elderly people to not stay silent as he had.Track Your Money And Assets At All Times And Don’t Let your Caretaker Get The Feeling They Aren’t Being WatchedFinancial crimes experts also urge victims to speak out and contact a lawyer or their state’s Adult Protective Services agency (Florida’s APS can be found here) if they are victims of abuse or deception. They say these crimes often start small with thefts of small items like jewelry and blank checks but increase over time if the smaller crimes go undetected. Track your money and assets at all times and don’t let your caretaker get the feeling they aren’t being watched.Often, when financial abuse happens, the defrauded person is afraid of looking foolish or causing anguish in the family. Caregivers often threaten or emotionally blackmail elders aga...

Think You Can Open A Restaurant And Succeed? Here's What It Takes

Want to open a restaurant? It’s not as easy as it looks. Find out what it takes to get your Michelin Star.

Money-Saving Advice For First Time Home Buyers

First time home buyers often make rookie mistakes that cost them tens of thousands in extra home-related costs. Here's what you need to avoid.

Dilbert Creator Explains Why President Trump Is A Master Persuader: Part I

Ever wonder why Trump’s slogans stick in your head while Democratic catchphrases fail to catch on? Dilbert creator Scott Adams gives us the scoop.

Dilbert Creator Explains Why President Trump Is A Master Persuader: Part II

Ever wonder why Trump’s slogans stick in your head while Democratic catchphrases fail to catch on? Dilbert creator Scott Adams gives us the scoop.

The New Tax Reform Plans: Who Wins, Who Loses?

The House and Senate tax reform bills create winners and losers. Will you fare better under the new plan or will your taxes get even more complex? Find out.

How Much House Can Your Money Buy?

Now that millennials are buying more homes, is housing affordability getting better or worse? And how much home can their money really buy?

How Much Does The Twelve Days Of Christmas Actually Cost

Here are some quirky ways to follow rising costs according to the 12 Days of Christmas.

Investment Alert: Is Your Employer’s 401(k) Plan Ripping You Off?

Several companies have mismanaged employee 401(k) contributions by charging excessive fees on underperforming funds. Make sure your 401(k) is well-managed.

Everything You Need To Know Before Your First Big Art Investment: Part I

Ever wondered how to tippy-toe into the daunting world of art collecting? We’ve got the answers on what to look for and art’s suitability as an investment.

Everything You Need To Know Before Your First Big Art Investment: Part II

Ever wondered how to tippy-toe into the daunting world of art collecting? We’ve got the answers on what to look for and art’s suitability as an investment.

Homes Are More Affordable Today Than 20 Years Ago

Unbelievably, as a percentage of median home income, monthly mortgages are more affordable today than 20 years ago. So it’s still a great time to buy!

The Art Of Saving For College In 5 Steps

Saving for college begins at birth. Here’s how you can calculate the cost of college before your child is out of diapers.

Warren Buffett's First $100 Million: The Early Successes & Failures

It wasn't all lollipops and roses in the beginning for Warren Buffett. Glen Arnold’s new book looks into the making of his first $100 Million...a great read.

Will Tax Reform Kill America’s Housing Market?

Tax reform proposals want to do away with the mortgage interest deduction. Will this kill America’s housing market?

Turns Out Lord Voldemort Makes A Great Financial Role Model

Learn from Lord Voldemort’s single-minded, self-denying, ruthless focus on achieving his goals and why he makes a perfect if unlikely financial role model.

Worried About Getting Bumped Off Your Next Flight? Know Your Airline Passenger Rights!

Wondering what your options are if you're delayed or bumped off the plane? We've got your airline passenger rights listed here so you'll know what to do.

Great Investors Have Great Instincts

With Vitaliy Katsenelson, CEO at Investment Management Associates and author of The Little Book of Sideways Markets, and Active Value InvestingVitaliy Katsenelson is Chief Investment Officer with Investment Management Associates and a well-known author of two books, The Little Book of Sideways Markets, and Active Value Investing. In addition, his articles have appeared in major financial magazines and journals.Vitaliy runs a blog called ContrarianEdge.com, which could give you some idea of the kind of investor he is. Conformity is not his style. In fact, he says, his style can best be described as being able to see things that others don’t; often that means doing the opposite of what the market's doing and being your own person.It’s not clairvoyanceVitaliy says that the vision of great investors has nothing to do with crystal balls but with having the right mental models; it’s the ability to see value where others don’t and following a consistent investment process time after time after time.To further explain his position, when analyzing an investment, Vitaliy asks himself these questions:Do I want to be in this business?Do I like the management?How well do they allocate capital?Do they have a process I can relate to?The contrarian way Sticking to your position, not conforming to the accepted view isn’t easy in any aspect of life. For an investor, especially operating under the pressure and responsibility of handling other people’s money, it’s especially difficult. You may know you’re right, but it takes courage to explain to your clients and get them to accept the contrarian mindset, especially when your decisions may seem wrong for a long period of time.When you have a situation where the market seems at odds with your instincts, Vitaliy follows a procedure that involves conferring with other respected investors to see all sides of the situation while figuring out what a company is worth. That takes work and a strong belief in your contrarian method.But sometimes you change direction.As committed as one may be to a credo, Vitaliy says it’s important for an investor to be able to change his mind. Using Warren Buffett (whom he greatly admires) as an example, Vitaliy states that even though Buffett has been quoted as saying he would never own an airline or a technology company, he eventually bought IBM and just recently purchased airline stock.The mark of a great investor is success and along with that is the ability “to constantly learn and then change your mind when you get an insight.” Something true of Vitaliy and all great investors.Disclosure: The opinions expressed are those of the interviewee and not necessarily United Capital. Interviewee is not a representative of United ...

Great Investors Have Great Instincts

With Vitaliy Katsenelson, CEO at Investment Management Associates and author of The Little Book of Sideways Markets, and Active Value InvestingVitaliy Katsenelson is Chief Investment Officer with Investment Management Associates and a well-known author of two books, The Little Book of Sideways Markets, and Active Value Investing. In addition, his articles have appeared in major financial magazines and journals.Vitaliy runs a blog called ContrarianEdge.com, which could give you some idea of the kind of investor he is. Conformity is not his style. In fact, he says, his style can best be described as being able to see things that others don’t; often that means doing the opposite of what the market's doing and being your own person.It’s not clairvoyanceVitaliy says that the vision of great investors has nothing to do with crystal balls but with having the right mental models; it’s the ability to see value where others don’t and following a consistent investment process time after time after time.To further explain his position, when analyzing an investment, Vitaliy asks himself these questions:Do I want to be in this business?Do I like the management?How well do they allocate capital?Do they have a process I can relate to?The contrarian way Sticking to your position, not conforming to the accepted view isn’t easy in any aspect of life. For an investor, especially operating under the pressure and responsibility of handling other people’s money, it’s especially difficult. You may know you’re right, but it takes courage to explain to your clients and get them to accept the contrarian mindset, especially when your decisions may seem wrong for a long period of time.When you have a situation where the market seems at odds with your instincts, Vitaliy follows a procedure that involves conferring with other respected investors to see all sides of the situation while figuring out what a company is worth. That takes work and a strong belief in your contrarian method.But sometimes you change direction.As committed as one may be to a credo, Vitaliy says it’s important for an investor to be able to change his mind. Using Warren Buffett (whom he greatly admires) as an example, Vitaliy states that even though Buffett has been quoted as saying he would never own an airline or a technology company, he eventually bought IBM and just recently purchased airline stock.The mark of a great investor is success and along with that is the ability “to constantly learn and then change your mind when you get an insight.” Something true of Vitaliy and all great investors.Disclosure: The opinions expressed are those of the interviewee and not necessarily United Capital. Interviewee is not a representative of United ...

How Much Longer Will This Bull Market Last?

The stock market has been on a tear since March 2009. So, are stocks overvalued and due for a market correction—or are they getting ready to soar?

Disciplined Growth Strategies Of Successful Companies

Looking for a great long-term growth company to add to your portfolio? Here's how successful CEOs use disciplined growth strategies to beat the competition.

Disciplined Growth Strategies Of Unsuccessful Companies

Steve and Peter break apart unsuccessful companies to learn "what not to do" when it comes to beating the competition.

How Online Shopping Is Forever Changing Real Estate As We Know It

Are deals like Amazon and Wholefoods upending real estate as we know it? Find out how all of this will impact your real estate investments.

The Best Times To Buy And Sell Homes

Americans are less willing to relocate for job opportunities than previous generations. Plus...what’s the best time to buy or sell a home?

You Are Your Own Biggest Motivator To Financial Success

Become your own biggest motivator for financial success. Here's how to channel your energies to save, invest, and become financially independent.

Could A Change In The Tax Code Drive Away Home Buyers?

Could the Republican’s tax code reform initiative drive away home buyers by eliminating the mortgage interest deduction?

Can You Become A Genius?

With Eric Weiner, Former NPR Foreign Correspondent, Author of The Geography of Genius: A Search for the World’s Most Creative Places. From Ancient Athens to Silicon ValleyIn discussing his latest book The Geography of Genius, geopolitical writer and foreign correspondent Eric Weiner defines genius as that person in our culture whose creativity hits a target no one else can see, thereby compelling the rest of the world to recognize and acknowledge the accomplishment, Einstein being a good example.He goes further to say that in order for these bursts of life-changing genius to occur, the cultural environment must be fertile and nurturing. He gives the analogy of a garden that needs the proper components of soil and nutrients in order to produce quality vegetables. Like the seed that flourishes in rich soil, genius occurs as a result of an idea or a discovery happening at an opportune time and place.Addressing the fact that there have been so few women geniuses, he states that women historically have been dominated and controlled by white men and therefore have not had the opportunity and the freedom to create and discover on a grand scale, dispelling the notion that genius is genetic.In addition, when the cultural environment is right, we get clusters of genius, for example, 15th century Florence which produced the original Renaissance Man, Leonardo da Vinci. The Medici and other Florentine families understood and appreciated art; they sought out great works and were generous in their patronage. The interest and the money of these families fostered a creative ecology where genius could develop and thrive.The Golden Age of Athens is another example of a fertile environment, but a completely different one from Florence. The ancient Greeks invented the symposium, a gathering place where men gathered and drank (albeit moderately) while discussing freely and without censure the great ideas that would be passed on to future generations and cultures.Somewhat like Greece, the people of Edinburgh, Scotland were able to take the ideas of others and greatly improve upon them—the steam engine being one of those massive improvements. Edinburgh, after having lost its independence to England, was a rough and difficult place to live. The Scots’ response to this intractable environment was the merging of ideas and innovation, which came to the forefront with their advancement in medicine. The Scots were masters of practical innovation.A common denominator of these genius clusters was some sort of chaos or trauma coming before. Athens had been burned to the ground; Florence had been decimated by the bubonic plague, as examples. These occurrences shook up the established social order. The chaos happens somewhere between the breaking down of the old order and the re-structuring of another, after which comes a new social order ripe for the emerging of ideas and cultural leaps.Weiner goes on to explain the genius cluster in Silicon Valley today emanating from, strangely enough, the sinking of the Titanic in 1912, after which all ships were required to have ship to shore radios on board. With a location far from the East Coast and the powerful money elite, Palo Alto, California and the area that makes up Silicon Valley had the freedom and the innovative thinking that spawned the Federal Telegraph Company, amateur radio, and other “tinkering” that led up to the tech world we live in today.To conclude,

How To Achieve Your Dreams And Take On The World

With Natalie MacNeil, Author of She Takes on the World and The Conquer Kit, Creator of SheTakesonTheWorld.comNatalie MacNeil is an entrepreneur, author, and speaker who focuses on the growing number of women starting their own businesses without an MBA or prior experience in financial or management areas. Filling that knowledge gap is what led to The Conquer Club, a 12-month business mentorship program designed to outfit these women with the skills and connections necessary to building and maintaining a successful company, and to take the steps to achieve your dreams.The value of the support system that The Conquer Club offers goes beyond the basic tenets of setting up and running the day to day operations; the value extends to showing varied perspectives from multiple points of view and experiences. For example, even the advice to hire a virtual assistant can be the impetus that allows a business to take a leap to the next level and on to greater success.On her website shetakesontheworld.com, Natalie shares many of the resources she uses in her own business—a bit like allowing a behind-the-scenes peek into how a business can change and improve along the way.While she understands the benefits of a 9-5 job, Natalie wants those women looking to transition to entrepreneurship to focus on the 5-9, by using those 3-4 hours of evening time to move the ball towards their goals, a few yards at a time.Natalie stresses the importance of doing the hard work, sticking to a plan, not giving up, and being persistent, much like with long-term investing. She also urges people to not shy away from sharing their opinions, even if that means facing criticism or creating controversy—because that’s what got her noticed.Disclosure: The opinions expressed are those of the interviewee and not necessarily United Capital. Interviewee is not a representative of United Capital. Investing involves risk and investors should carefully consider their own investment objectives and never rely on any single chart, graph or marketing piece to make decisions. Content provided is intended for informational purposes only, is not a recommendation to buy or sell any securities, and should not be considered tax, legal, investment advice. Please contact your tax, legal, financial professional with questions about your specific needs and circumstances. The information contained herein was obtained from sources believed to be reliable, however their accuracy and completeness cannot be guaranteed. All data are driven from publicly available information and has not been independently verified by United Capital.

Reorganizing Your Life For Comfortable Retirement

With Donna Rosato, Senior Writer at Money MagazineAs we go through our adult lives, it’s important to periodically check our vital signs, for both our physical and our financial health. Donna Rosato, a senior writer at Money Magazine, has the protocol for making certain that all aspects of our money life are monitored on a regular basis, thereby ensuring that we’re prepared for retirement and also for encountering those inevitable emergency situations.Donna’s recommended checklist for assessing your financial well-being includes keeping tabs on your credit score, regularly contributing to a retirement fund, and maintaining an emergency fund of about six months of living expenses for any of life’s surprises.Even though people are feeling more secure in the job market today, it’s important to be constantly on guard for potential pitfalls. For example, if you live in an area that depends on the status of one industry and that industry fails, the value in your home could be affected. Donna advises assessing risks along the way and making financial adjustments accordingly.Setting goals and making a plan to achieve those goals, whether it be a trip to Bali or paying off a student loan, is a strong motivator for success. And following through is much easier with either a visual reminder such as a picture board in your workspace or utilizing one of the tech tools which hit you with a reminder notice that it’s time to contribute to that fund—and then you have the pleasure of watching the dream incrementally materialize.Disclosure: The opinions expressed are those of the interviewee and not necessarily United Capital. Interviewee is not a representative of United Capital. Investing involves risk and investors should carefully consider their own investment objectives and never rely on any single chart, graph or marketing piece to make decisions. Content provided is intended for informational purposes only, is not a recommendation to buy or sell any securities, and should not be considered tax, legal, investment advice. Please contact your tax, legal, financial professional with questions about your specific needs and circumstances. The information contained herein was obtained from sources believed to be reliable, however their accuracy and completeness cannot be guaranteed. All data are driven from publicly available information and has not been independently verified by United Capital.

How The Media Hijacks Your Mind Without You Knowing It!

Our minds are hardwired with availability bias, which can influence our investment decisions unless we consciously recognize this and step in to stop it.

How The Media Hijacks Your Mind Without You Knowing It!

Our minds are hardwired with availability bias, which can influence our investment decisions unless we consciously recognize this and step in to stop it.

Understanding Bitcoin And Its Future

Bitcoins have soared in value to about $7,000 apiece. So, would you buy some for your retirement portfolio or is it a bubble to sucker you in?

Understanding Bitcoin And Its Future

Bitcoins have soared in value to about $7,000 apiece. So, would you buy some for your retirement portfolio or is it a bubble to sucker you in?

How To Spot Elder Abuse And Prevent It

Would you recognize elder abuse if you saw it? Here's what you should do to prevent it and how to report it. Michael Hackard has the answers.

How To Spot Elder Abuse And Prevent It

Would you recognize elder abuse if you saw it? Here's what you should do to prevent it and how to report it. Michael Hackard has the answers.

Can Individuals With Tenacious Moral Fiber Succeed In Today's World?

How much moral fiber should companies have? Expert Shawn Vij explains why ethical business practices promote personal and professional growth.

Can Individuals With Tenacious Moral Fiber Succeed In Today's World?

How much moral fiber should companies have? Expert Shawn Vij explains why ethical business practices promote personal and professional growth.

Think Twice Before Adding Children To Your House Deed

Should adults add a child’s name to the house deed? Real Estate Round-Up has the answer, along with an update on the U.S. housing market.

Think Twice Before Adding Children To Your House Deed

Should adults add a child’s name to the house deed? Real Estate Round-Up has the answer, along with an update on the U.S. housing market.

An In-Depth Look At The Greatest Minds Of Investing

William Green discusses his new book Great Minds of Investing which offers a human look at some of the most successful iconic investors in the world.

A Great Investor's Million Dollar Secret

With Mohnish Pabrai, managing partner of Pabrai Investment FundsMohnish Pabrai, managing partner of Pabrai Investment Funds which he founded in 1999 is considered to be one of the world's greatest investors and is this week’s addition to our “Great Investor” series.Back in ‘94, Mohnish was the owner of a successful IT firm when a window opened into a new world as he began hearing and reading about Warren Buffett. He was particularly intrigued by the concept of compounding which Einstein called the “eighth wonder of the world,” leading Buffett to know early on that he would one day be rich. From there, Mohnish began his own compounding engine that eventually took him into a new direction.Wise words from Warren BuffettWarren Buffett has often been quoted as saying, "I'm a better investor because I'm a businessman, and I'm a better businessman because I'm an investor.” Mohnish took the core principle of these words and approached every buy as though he were buying either a fraction of or an entire business. Still within what he calls his learning period of the mid-90s, heheld on to the basic ideas of buying a dollar for well under a dollar and looking for businesses that were within the circle of competence.Looking for the upside without a downside.After following such great investors as Warren Buffett, Charlie Munger and others—whose style of investing went against the grain of most mutual fund investors at that time who were rapidly turning over scores of stocks with little or no regard to the intrinsic value of the businesses themselves—Mohnish set up The Pabrai Fund in 1999.Contrary to the perception of the entrepreneur as risk-taker, Mohnish is quick to point out that successful entrepreneurs try to minimize risk and instead look for a business with the lowest risk possible but one with the highest potential rewards—the upside without a downside. He mentions Richard Branson as someone who has managed spectacularly well in this regard.Lunch with WarrenIn 2007, Mohnish won the coveted bid to have lunch with Warren Buffett. During that time, Warren spoke about integrity and, in explaining his internal yardstick, he asked the question "Would you prefer to be the greatest lover in the world and known as the worst or would you prefer to be the worst lover in the world and known as the greatest?" He then said, "If you answer that correctly, then you have the right internal yardstick."The takeaway for Mohnish from that lunch was that Warren highly values both integrity and truthfulness and looks to his inner scorecard in both investing and in life. Neither Charlie Munger nor Warren Buffett pays attention to what we would consider either acceptable investments or acceptable behavior.Peter Kaufman’s 3 reasons for great successAnother of Mohnish’s influencers was Peter Kaufman who interviewed both Warren and his partner Charlie Munger for his book Poor Charlie's Almanack, in which he listed the three reasons for their success:* The willingness to be patient. Charlie Munger said they don't make money when they buy stocks, and they don't make money when they sell stocks, they make money by being patient.* Extreme decisiveness. You must be willing to bet heavily if the opportunity strikes.* Having no concern about being different from the crowd.The keys to great investingBecoming rich takes certain deliberate actions, according to Mohnish. Point by point, he advises:-begin early, in your 20s, if possible-always spend less than you earn-take advantage of tax laws, IRAs, 401ks, etc-invest in low-cost index funds“Dollar-cost average that in throughout your life,” he says, “and even at very modest annual returns and very modest savings rates,

A Great Investor's Million Dollar Secret

With Mohnish Pabrai, managing partner of Pabrai Investment FundsMohnish Pabrai, managing partner of Pabrai Investment Funds which he founded in 1999 is considered to be one of the world's greatest investors and is this week’s addition to our “Great Investor” series.Back in ‘94, Mohnish was the owner of a successful IT firm when a window opened into a new world as he began hearing and reading about Warren Buffett. He was particularly intrigued by the concept of compounding which Einstein called the “eighth wonder of the world,” leading Buffett to know early on that he would one day be rich. From there, Mohnish began his own compounding engine that eventually took him into a new direction.Wise words from Warren BuffettWarren Buffett has often been quoted as saying, "I'm a better investor because I'm a businessman, and I'm a better businessman because I'm an investor.” Mohnish took the core principle of these words and approached every buy as though he were buying either a fraction of or an entire business. Still within what he calls his learning period of the mid-90s, heheld on to the basic ideas of buying a dollar for well under a dollar and looking for businesses that were within the circle of competence.Looking for the upside without a downside.After following such great investors as Warren Buffett, Charlie Munger and others—whose style of investing went against the grain of most mutual fund investors at that time who were rapidly turning over scores of stocks with little or no regard to the intrinsic value of the businesses themselves—Mohnish set up The Pabrai Fund in 1999.Contrary to the perception of the entrepreneur as risk-taker, Mohnish is quick to point out that successful entrepreneurs try to minimize risk and instead look for a business with the lowest risk possible but one with the highest potential rewards—the upside without a downside. He mentions Richard Branson as someone who has managed spectacularly well in this regard.Lunch with WarrenIn 2007, Mohnish won the coveted bid to have lunch with Warren Buffett. During that time, Warren spoke about integrity and, in explaining his internal yardstick, he asked the question "Would you prefer to be the greatest lover in the world and known as the worst or would you prefer to be the worst lover in the world and known as the greatest?" He then said, "If you answer that correctly, then you have the right internal yardstick."The takeaway for Mohnish from that lunch was that Warren highly values both integrity and truthfulness and looks to his inner scorecard in both investing and in life. Neither Charlie Munger nor Warren Buffett pays attention to what we would consider either acceptable investments or acceptable behavior.Peter Kaufman’s 3 reasons for great successAnother of Mohnish’s influencers was Peter Kaufman who interviewed both Warren and his partner Charlie Munger for his book Poor Charlie's Almanack, in which he listed the three reasons for their success:* The willingness to be patient. Charlie Munger said they don't make money when they buy stocks, and they don't make money when they sell stocks, they make money by being patient.* Extreme decisiveness. You must be willing to bet heavily if the opportunity strikes.* Having no concern about being different from the crowd.The keys to great investingBecoming rich takes certain deliberate actions, according to Mohnish. Point by point, he advises:-begin early, in your 20s, if possible-always spend less than you earn-take advantage of tax laws, IRAs, 401ks, etc-invest in low-cost index funds“Dollar-cost average that in throughout your life,” he says, “and even at very modest annual returns and very modest savings rates,

Turns Out All Great Investors Take The Road Less Traveled

With Tom Russo, Managing Partner at Gardner Russo & GardnerAs part of our new “Great Investor Series,” this is the first “What’s in Their Wallet” segment which can also be found here.Tom Russo, Managing Partner at Gardner Russo & Gardner, a hedge fund managing about $12 billion, is a recognized thought leader in the field of investments and devotes time lecturing and educating students.Before we see what makes Tom a Great Investor, it’s interesting to hear how it all began for him, how he segued from a career in law to the world of finance as a money manager when circumstance put one of the greatest investors of all time in his path.An Early Lesson in Investing from Warren BuffettAs Tom tells it, he was a student in 1982 at Stanford’s Law and Business Graduate Program when his value investment professor brought in one of his colleagues to speak to the class—that colleague turned out to be Warren Buffett. Where most investment conversation at the time had to do with modern portfolio theory, Tom recalls that Mr. Buffett spoke about investing in businesses as though you owned them yourself with such “clarity of thought it that parted the way for me.”At that defining moment of Tom Russo’s career, Buffett laid out a specific 3-prong analysis of what a business must possess to have a competitive advantage:* The non-taxation of unrealized gains, which requires the investor to think about businesses that have the capacity to grow, the capacity to reinvest.* Before investing, you must know that the management whom you trust to reinvest will do so with the owner’s, rather than the management’s, interest in mind.* Invest in businesses that you like because you’ll probably work harder at it and be more intuitive about it.By following these guidelines through the years, Tom says sixty-plus percent of his investments have been in family-controlled companies, which to some may imply more risk, but in actuality, there is less risk. In addition, the favored companies are ones that throw off a lot of cash, are able to reinvest that cash successfully, and have global aspirations and brand recognition.A Great Investor Knows the Difference Between Instant and Slow Roasted CoffeeTo be a smart investor, Tom advises, you must have a long-term view and the capacity to suffer; you want to invest in companies willing to make strategic moves in a timely mindful manner that will pay off in the future and one that is strong enough to keep corporate raiders from breaking through the door.It took Nestle 15 years to perfect Nespresso, the most successful premium single-portioned coffee on the market. During those developmental years of laboring over the crema, the beans, the scent, the bar pressure, the technology, and the marketing strategy, imitators rushed to the scene, pushed their products out the door, and ultimately failed. Nestle, by taking its time, did it right and launched a classy, profitable member of the Nestle Group.Stock Options: Who Wins And Who Loses?One of the reasons Tom says he’s invested so highly in internationally based companies is that they use stock options as a far smaller portion of compensation than they do in the US, where the practice of dangling stock options has actually become a destructive practice.Tom explains, “With options, you suddenly introduce into the equation of reinvestment an element called time. Your options are good for three years, and if the price isn't $72.50 three years from now, they're worthless. You as the manager have every ability to deliver the kind of results that Wall Street demands of you to get to $72.50 in three years, but that might actually come at the cost of the future because you may cut spending. You may make the numbers and ruin the value of the company in ...

Turns Out All Great Investors Take The Road Less Traveled

With Tom Russo, Managing Partner at Gardner Russo & GardnerAs part of our new “Great Investor Series,” this is the first “What’s in Their Wallet” segment which can also be found here.Tom Russo, Managing Partner at Gardner Russo & Gardner, a hedge fund managing about $12 billion, is a recognized thought leader in the field of investments and devotes time lecturing and educating students.Before we see what makes Tom a Great Investor, it’s interesting to hear how it all began for him, how he segued from a career in law to the world of finance as a money manager when circumstance put one of the greatest investors of all time in his path.An Early Lesson in Investing from Warren BuffettAs Tom tells it, he was a student in 1982 at Stanford’s Law and Business Graduate Program when his value investment professor brought in one of his colleagues to speak to the class—that colleague turned out to be Warren Buffett. Where most investment conversation at the time had to do with modern portfolio theory, Tom recalls that Mr. Buffett spoke about investing in businesses as though you owned them yourself with such “clarity of thought it that parted the way for me.”At that defining moment of Tom Russo’s career, Buffett laid out a specific 3-prong analysis of what a business must possess to have a competitive advantage:* The non-taxation of unrealized gains, which requires the investor to think about businesses that have the capacity to grow, the capacity to reinvest.* Before investing, you must know that the management whom you trust to reinvest will do so with the owner’s, rather than the management’s, interest in mind.* Invest in businesses that you like because you’ll probably work harder at it and be more intuitive about it.By following these guidelines through the years, Tom says sixty-plus percent of his investments have been in family-controlled companies, which to some may imply more risk, but in actuality, there is less risk. In addition, the favored companies are ones that throw off a lot of cash, are able to reinvest that cash successfully, and have global aspirations and brand recognition.A Great Investor Knows the Difference Between Instant and Slow Roasted CoffeeTo be a smart investor, Tom advises, you must have a long-term view and the capacity to suffer; you want to invest in companies willing to make strategic moves in a timely mindful manner that will pay off in the future and one that is strong enough to keep corporate raiders from breaking through the door.It took Nestle 15 years to perfect Nespresso, the most successful premium single-portioned coffee on the market. During those developmental years of laboring over the crema, the beans, the scent, the bar pressure, the technology, and the marketing strategy, imitators rushed to the scene, pushed their products out the door, and ultimately failed. Nestle, by taking its time, did it right and launched a classy, profitable member of the Nestle Group.Stock Options: Who Wins And Who Loses?One of the reasons Tom says he’s invested so highly in internationally based companies is that they use stock options as a far smaller portion of compensation than they do in the US, where the practice of dangling stock options has actually become a destructive practice.Tom explains, “With options, you suddenly introduce into the equation of reinvestment an element called time. Your options are good for three years, and if the price isn't $72.50 three years from now, they're worthless. You as the manager have every ability to deliver the kind of results that Wall Street demands of you to get to $72.50 in three years, but that might actually come at the cost of the future because you may cut spending. You may make the numbers and ruin the value of the company in ...

Best Selling Author Nelson DeMille Explains How To Make A Blockbuster Book

There’s a lot more competition in a market influenced by Internet and smartphones. Luckily, Nelson DeMille explains how to still come out on top.

Best Selling Author Nelson DeMille Explains How To Make A Blockbuster Book

There’s a lot more competition in a market influenced by Internet and smartphones. Luckily, Nelson DeMille explains how to still come out on top.

Hiding in the Bathroom: An Introvert’s Guide To Overcoming Social Anxiety

It’s quite possible that the person enthralling everyone with a great story and amazing sales pitch is actually a silently, suffering introvert.

Hiding in the Bathroom: An Introvert’s Guide To Overcoming Social Anxiety

It’s quite possible that the person enthralling everyone with a great story and amazing sales pitch is actually a silently, suffering introvert.

What Do You Do If You Have A Bad Condo Board?

Living with a bad Condo Board? Here are your options.

What Do You Do If You Have A Bad Condo Board?

Living with a bad Condo Board? Here are your options.

New Report! Surprise Savings You Didn't Know Existed At Warehouse Clubs

Turns out Costco & BJ's offer significant savings on things other than your 15-pack of paper towels and 40 pounds of dog food. Here's the breakdown.

New Report! Surprise Savings You Didn't Know Existed At Warehouse Clubs

Turns out Costco & BJ's offer significant savings on things other than your 15-pack of paper towels and 40 pounds of dog food. Here's the breakdown.

401(k) Pros and Cons You Should Not Ignore

Tax deferred investments don’t always make sense for several reasons. So, make sure you understand these 401(k) pros and cons before you dive in.

A Peek Inside The Wallet Of Another Great Investor

With Mohamed El-Erian, Bloomberg View columnist, Chief Economic Advisor at Allianz, and Chairman of President Obama's Global Development CouncilContinuing with our new series called “The Great Investors, What's in their Wallet?” The Steve Pomeranz Show has invited Mohamed El-Erian, truly one of the world’s greatest investors, to speak about his personal investing practices.Mohamed is a Bloomberg View columnist, Chief Economic Advisor at Allianz, and Chairman of President Obama's Global Development Council. In previous interviews, we discussed his latest book, The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse, and he helped us understand and get some needed perspective on the implications of the Brexit referendum, when that was a big issue a few months ago.A Peek Inside Mohamed’s “Wallet”It may be surprising to learn that about 30% of Mohamed’s portfolio is in cash at the moment, which Mohamed acknowledges doesn’t pay him anything at all. He states, in fact, that inflation actually eats away the real purchasing power of that cash. So how does he explain his present position?“We have been living through a very unusual period in which financial assets have been decoupled from fundamentals and for good reason. Central banks have tried to use the financial markets as a way of promoting growth, by pushing up artificially asset prices, making people feel richer, and triggering the wealth effect, so they'd go out and spend more. Unfortunately, it hasn't worked.”The Investor’s DefenseWith central banks becoming less effective, the smart investor responds with resilience, in case prices do go down, and with agility to take advantage of overshoots. In that vein, Mohamed says he has reduced his holdings of public equities and public bonds and moved those mostly into cash, and, in addition, has invested more actively in venture capital.Dealing With Artificially Low-Interest RatesIn spite of the fact that stock prices are high relative to other risky investments, stocks are still an attractive option, and the equity market, says Mohamed, “is the only place you can get any returns or expect to get any returns.” In order to keep the economy moving forward, the Fed has created artificially low-interest rates, which, in turn, has produced an over-priced market. At some point, prices will go down and having cash on hand enables an investor to buy at more attractive prices when that does occur.The Illuminating Tale of the Dog and The CatTo illustrate the concept of buying in an artificially priced market, Mohamed uses the example of the dog and the cat. There's a cat that you can buy at $30,000, but there's a dog that you can buy at $10,000. How would you choose? You might say, "I'd rather buy a dog at $10,000." But, says Mohamed, “that doesn't make it a good thing to do. It may be cheaper in relative terms, but in absolute terms it's expensive.” And not a smart investment.Choosing Your Mistakes as an InvestorConsidering the many unknowns in the marketplace, it’s not possible to cover all bases when deciding where and how to invest, and the choice of either staying out of the market and waiting it out or going “all-in” is crucial. So which way do you go? Mohamed says “it's better to recover from a mistake where you've left some money on the table than one in which you've lost quite a bit of money fast.” Venturing into the Venture SideWith the stock market having done well this year, Mohamed has offset the 0% earnings on his cash by focusing on venture capital investments. Venture capital investments are early stage, risky investments in which you get an equity stake in the business with the hope that it will give b...

A Peek Inside The Wallet Of Another Great Investor

With Mohamed El-Erian, Bloomberg View columnist, Chief Economic Advisor at Allianz, and Chairman of President Obama's Global Development CouncilContinuing with our new series called “The Great Investors, What's in their Wallet?” The Steve Pomeranz Show has invited Mohamed El-Erian, truly one of the world’s greatest investors, to speak about his personal investing practices.Mohamed is a Bloomberg View columnist, Chief Economic Advisor at Allianz, and Chairman of President Obama's Global Development Council. In previous interviews, we discussed his latest book, The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse, and he helped us understand and get some needed perspective on the implications of the Brexit referendum, when that was a big issue a few months ago.A Peek Inside Mohamed’s “Wallet”It may be surprising to learn that about 30% of Mohamed’s portfolio is in cash at the moment, which Mohamed acknowledges doesn’t pay him anything at all. He states, in fact, that inflation actually eats away the real purchasing power of that cash. So how does he explain his present position?“We have been living through a very unusual period in which financial assets have been decoupled from fundamentals and for good reason. Central banks have tried to use the financial markets as a way of promoting growth, by pushing up artificially asset prices, making people feel richer, and triggering the wealth effect, so they'd go out and spend more. Unfortunately, it hasn't worked.”The Investor’s DefenseWith central banks becoming less effective, the smart investor responds with resilience, in case prices do go down, and with agility to take advantage of overshoots. In that vein, Mohamed says he has reduced his holdings of public equities and public bonds and moved those mostly into cash, and, in addition, has invested more actively in venture capital.Dealing With Artificially Low-Interest RatesIn spite of the fact that stock prices are high relative to other risky investments, stocks are still an attractive option, and the equity market, says Mohamed, “is the only place you can get any returns or expect to get any returns.” In order to keep the economy moving forward, the Fed has created artificially low-interest rates, which, in turn, has produced an over-priced market. At some point, prices will go down and having cash on hand enables an investor to buy at more attractive prices when that does occur.The Illuminating Tale of the Dog and The CatTo illustrate the concept of buying in an artificially priced market, Mohamed uses the example of the dog and the cat. There's a cat that you can buy at $30,000, but there's a dog that you can buy at $10,000. How would you choose? You might say, "I'd rather buy a dog at $10,000." But, says Mohamed, “that doesn't make it a good thing to do. It may be cheaper in relative terms, but in absolute terms it's expensive.” And not a smart investment.Choosing Your Mistakes as an InvestorConsidering the many unknowns in the marketplace, it’s not possible to cover all bases when deciding where and how to invest, and the choice of either staying out of the market and waiting it out or going “all-in” is crucial. So which way do you go? Mohamed says “it's better to recover from a mistake where you've left some money on the table than one in which you've lost quite a bit of money fast.” Venturing into the Venture SideWith the stock market having done well this year, Mohamed has offset the 0% earnings on his cash by focusing on venture capital investments. Venture capital investments are early stage, risky investments in which you get an equity stake in the business with the hope that it will give b...

Improve Your Financial Life In Just 3 Weeks

Want to improve your financial life fast? Christine Benz has made complicated easy with this 21-day challenge. So why don't you start right now?

Improve Your Financial Life In Just 3 Weeks

Want to improve your financial life fast? Christine Benz has made complicated easy with this 21-day challenge. So why don't you start right now?

Achieve Your Dreams In Retirement With Unretirement

Unretirement is about leading a full life in retirement, maximizing your potential, and achieving your dreams. It's so good, it's almost too good to be true.

Sports & Stocks: When Winning Is Everything

Ever wonder what sports and stocks have in common? Here's how to apply winning sports strategies to your investment efforts.

Sports & Stocks: When Winning Is Everything

Ever wonder what sports and stocks have in common? Here's how to apply winning sports strategies to your investment efforts.

Are Bitcoins Really Worth Anything Or Just A Bubble Waiting To Burst?

Bitcoin has soared in value since its debut five years ago. Are Bitcoins really worth the digits they're "printed" on?

Are Bitcoins Really Worth Anything Or Just A Bubble Waiting To Burst?

Bitcoin has soared in value since its debut five years ago. Are Bitcoins really worth the digits they're "printed" on?

The Grey Nomad: Surviving As A Low Income Senior

The 2008 housing and market crashes hit many US seniors especially hard. Here's how it's affected their retirement income.

How To Retire Well

First rule in how to retire? Plan for the unplanned so there's no surprises.

Hot Off The Press! The First 2018 Housing Outlook

Freddie Mac’s 2018 housing outlook predicts a rise in new home inventory, higher mortgage interest rates and a modest increase in home prices.

Should You Be A Copycat Investor?

Piggyback investing alongside your investment gurus is easy to do but in no way guarantees that those very same investments will perform as well for you.

10 Best & Worst College Majors For A Lucrative Career

The best college majors could pay as much as $3.4 million more in lifetime earnings than the worst college majors.

The Kardashians: An American Drama

Jerry Oppenheimer’s new book, The Kardashians: An American Drama, reveals some interesting facts about their rise to the top you may not have known...

Calling All Small Investors! Here’s A Guide Just For You

Small investors can reap sizable investment gains, even on relatively small portfolios, if they take advantage of low cost ways to grow their money.

Home Prices Have Been Up Every Month, But Where’s The Inventory?

Home prices have risen every month for the past 66 months but tight inventory continues to hold down home sales.

Irma's Economic Impact Could Be 200% More Than Katrina

Hurricane Irma’s economic impact could be as much as $190 billion, 200 percent more than Katrina’s costs, because of Florida’s rapidly growing population.

The Woman Who Smashed Codes:The Unlikely Heroine Who Outwitted America's Enemies

In his novel, The Woman Who Smashed Codes, Jason Fagone shines a light on unsung heroine, Elizebeth Friedman, and her pioneering work in cryptography.

Boston Globe's Black Mass Journalist Tackles A Glaring Injustice In His New Novel, Trell

Dick Lehr’s new novel, Trell, is inspired by the true story of a young man's false imprisonment for murder and those who fought to free him.

Trump Tax Plan: Long On Promises, Short On Details

Trump tax plan lowers tax brackets but is woefully short on details. Here's what we've put together so far.

Yes, Florida Home Sales Are Rising After Hurricane Irma

Floridians appear to have stepped up home selling activity in the aftermath of Hurricane Irma. Plus, Terry’s advice on roof re-inspections after a storm.

Fake Financial News Or Trusted Source? Know The Difference

The ease of putting up a blog or an investment research website has spawned an industry of fake financial news. Make sure you're not its next victim.

How To Protect Yourself After The Massive Equifax Data Breach

Your personal data was almost certainly compromised in the Equifax data breach, so check if you’ve been impacted and take steps to protect your credit.

The Memo You May Have Missed: John Hope Bryant's Five Rules For Financial Freedom

In his new book, The Memo: Five Rules for Your Economic Liberation, John Hope Bryant lays out five rules for achieving financial freedom.

Purge Before You Splurge (On A New House)

Getting a start on a new house can also mean getting a fresh start with your stuff... Here's what needs to go.

How To Return To Work As A New Mother Successfully

With Cheryl Casone, reporter and anchor for Fox Business Network, Author of The Comeback: How Today's Moms Reenter the Workplace SuccessfullyThe stay at home mom is a dinosaur from days long gone. Whether from economic necessity or desire, most moms today are either already out in the workforce or they’re returning after time out to raise children. Recognizing that reentry after a long hiatus from earning a paycheck can be an intimidating venture, Cheryl Casone, reporter and anchor for Fox Business Network, wrote a book on the subject called The Comeback: How Today's Moms Reenter the Workplace Successfully. Cheryl herself grew up with a working mom which she says was her inspiration for living her own life and for mentoring other women who may be agonizing over the guilt of leaving their children coupled with the insecurity of going back into an arena where the rules have changed.The two biggest concerns women have about the return to work after having children, says Cheryl are: The kids will suffer; I won’t have anything to offer; my skills are rusty or out of date.”To counter these fears, Cheryl points to a recent Harvard University study that interviewed both mothers and daughters of over 50,000 women in 25 countries and concluded that daughters, in particular—but sons as well—were more successful and reported higher levels of work/life balance than children raised by mothers who never worked. This cultural shift is light years away from the days of Leave it to Beaver.In researching her book, Cheryl interviewed over 100 women many of whose stories are cited in the book as supporting testimony for the findings from the Harvard study.Acknowledging the obstacles facing many women wanting to return to the business world, Cheryl offers invaluable advice on how to navigate back to a satisfactory position in the workplace.* Before leaving your present job, she counsels, always secure contact information for your colleagues, so you can keep in touch from home.* Social media means you never have to be in isolation. The world is right there on your screen, so maintain those contacts during your time off from work. Also, reach out for actual face-to-face meet ups with local colleagues.* Acknowledge that after being at home for a while, you might have to accept less money or a different title.* Building a resume is a key factor in presenting yourself as a prospective employee. Cheryl’s advice is to emphasize your strong points at the top of the page, front and center, and to not minimize some of the skills you’ve used at home, such as negotiating, multi-tasking, and organizing.The Comeback: How Today's Moms Reenter the Workplace Successfully is a self-help book that will coach you back into the workplace. Cheryl gives you advice, resources, and courage to go confidently into the arena of the successful working mom.Disclosure: The opinions expressed are those of the interviewee and not necessarily United Capital. Interviewee is not a representative of United Capital.

Naked Retirement: Prepare To Bare It all In Your Golden Years

In Naked Retirement, Robert Laura shows people how to lead fulfilled lives in retirement by being financially, emotionally, and professionally prepared.

Your Kids Want Your Money: Will Giving It To Them Put Your Future In Jeopardy?

Most parents want to help with their children’s financial needs, but juggling their requests with your retirement demands will take some financial finesse.

Buyer Beware: Flipped Homes Could Be A Real Nightmare If You're Not Careful

Be careful buying flipped homes because "Home Flippers" have little motivation to take care of the property and may not be around if you have problems later.

Hurricane Season Got You Down? Get Back Up With These Disaster Survival Tips

Hurricane fatigue? Here's some disaster survival tips to help you get it together without too much headache.

Norm Champ Goes Public With His Adventures Inside The SEC – Post Madoff

In his book, Going Public: My Adventures Inside the SEC and How to Prevent the Next Devastating Crisis, Norm Champ discusses what he learned during his SEC tenure.

Number Crunchers Unite! We Need You More Than Ever

WSJ's Greg Ip bravely defends Economists in his article, “In Defense of the Dismal Science", while Steve praises all "bean-counters" who search for truth in numbers.

Number Crunchers Unite! We Need You More Than Ever (Part II)

WSJ's Greg Ip bravely defends Economists in his article, “In Defense of the Dismal Science", while Steve praises all "bean-counters" who search for truth in numbers.

Tiny Homes: Big Hope Or Big Hype?

Tiny homes are big in the news, but before you commit, consider zoning laws, insurance and mortgage options, resale values, and your long-term needs.

401(k) Pros and Cons You Should Not Ignore

Tax deferred investments don’t always make sense for several reasons. So, make sure you understand these 401(k) pros and cons before you dive in.

Lessons From Game Of Thrones And The Power Of Money

Here are the most important financial lessons from Game of Thrones—from power shifts to warring families, to winning strategies for your portfolio.

Structured Settlements Are For Suckers

Should you be wary of structured settlements? This expert says you should be afraid, very afraid...

Be Alert! Hackers Are Stealing Millions From Buyers By Using These Real Estate Scams

With hackers getting busier, bolder, and smarter by the minute, protect yourself from potentially disastrous real estate scams in this age of digital money.

Divorce Planning: Why Divvying Up Financial Assets Is No Cake Walk

with Matthew Lundy, Esq., Certified Divorce Financial AnalystDivorce Planning For Financial AssetsMatthew L. Lundy, Esq. and his law firm specialize in handling domestic relations and family law litigation, along with divorce planning and estate planning. He has developed a reputation as a young lawyer with a special skill for handling complicated legal issues. Matthew has been honored as a "Rising Star" by Super Lawyers Magazine and as an “Outstanding Young Lawyer” by the American Registry.Matt has seen a lot of complicated cases and has helped many deserving individuals get their fair share in retirement. He also addresses the impact of market fluctuations on retirement portfolio values and how a couple should navigate the complicated finances behind divorce. He sheds light on the complexities behind retirement accounts and offers divorce planning tips on how to divide assets, especially equity assets, so you don’t lose out by having to sell when the market is down.Qualified Domestic Relations OrderMatt explains his specialty, the QDRO, Qualified Domestic Relations Order, a term that often comes up in divorce cases and is a court order that essentially divides up retirement plans for couples going through divorce. Plans include any retirement and pension plans set up by employers in the private sector under the Employee Retirement Income Security Act of 1974 (ERISA).He says QDROs are complicated because the subject matter of retirement plans is complicated and goes beyond what most people need to know on a routine basis, which is how much they have in the plan, what their holdings are, and a few trading basics. In divorce planning, you have to get very specific about what the plan is and how it's being divided. It’s not as easy as a simple “divide by two” because it depends on the securities you hold in the plan. He cites the example of a checking account, where the cash value does not fluctuate if you make no transactions, so that is easy to divide. But when a retirement account has a collection of fairly complicated investments—with stocks, options, mutual funds, ETFs, bonds, etc.—values can sharply change within a few hours/days/weeks, so categorizing what is in the portfolio and determining how and when it should be divided is no straightforward task.Matt’s Most Interesting Case—The Uncompromising PilotOn Steve’s prompting, Matt says he has seen a lot of interesting cases in divorce planning, in the context of family law.One case that stands out for him, very early in his career, is where a woman with two children was getting a divorce. Her husband, who was a pilot and made about $200,000 a year, refused to pay any child support or alimony. He wouldn't even pay for the house and, basically, abandoned everybody and left.The woman was in dire need of money when she came to Matt’s law firm. They went straight to court. On hearing her case, the judge was absolutely irate with her husband for his behavior and wanted to throw him in jail.Rather than have him thrown in jail, however, Matt and his team asked the judge to enter a QDRO for the entire balance of the husband’s 401(k), which was about $400,000. The judge agreed and took the entire account and assigned it to her. Essentially, what they did was use the QDRO as an enforcement mechanism for a non-compliant person.Everyone Loses With A Shrinking PortfolioNext, Steve wonders what happens when a plan’s assets shrink over the course of a year, say from $500,000 to $250,000. Matt says those are classified as passive gains and losses based on market fluctuations, and each party eats half the loss.Within the purview of divorce planning, he also talks about the more complicated division of Defined Benefit Plans that factor in issues such as the income stream, periodic cost-of-living adjustments,

Want To Quit Your Job NOW? Consider These 8 Affordable Places To Live

If quitting your job and living abroad sounds appealing, check out this list of the 8 most affordable places to live outside the U.S.

Liberate Your College Savings With A 529 Plan

To make the most of a tax-advantaged, college savings 529 Plan, front-load investments, minimize fees and penalties, add beneficiaries, and avoid taxes.

The Gender Pay Gap Is Real! Here's How To Handle It Like A Pro

In today’s world, it’s best to be upfront about money issues early in a relationship and openly address gender pay gap issues in the workplace.

The Fun Way To Help Your Kids Become Successful Entrepreneurs

JJ Ramberg explains how to help your kids become successful entrepreneurs and give them "a leg up" in business & life.

Have You Been A Victim Of Home Buyer's Remorse?

Make sure you’re not a victim of home buyer’s remorse by thoroughly checking out the home and making sure the neighborhood fits your lifestyle and needs.

Turns Out Lord Voldemort Makes A Great Financial Role Model

Learn from Lord Voldemort’s single-minded, self-denying, ruthless focus on achieving his goals and why he makes a perfect if unlikely financial role model.

Looking For Financial Success? Follow These Simple Steps

You too can become a financial success if you put your mind to it. Just follow a few simple steps and stick with the program. It’s easier than you think!

2017 Stock Market Outlook: A Mid-Year Analysis

BlackRock sees low economic volatility & strong global growth in its 2017 stock market outlook. Conclusion: Stick with stocks for now & consider investing abroad.

Lower Your Interest Rate On College Debt With A ‘Student Loan Cash Out Refinance' Program

Fannie Mae’s new "student loan cash out refinance" program makes it easier to pay off student loans at a lower interest rate by refinancing your mortgage.

Smart Money's New Wave: Smart Beta ETFs

Smart Beta ETFs are growing at twice the rate of index ETFs and are poised to become the next big innovation in asset management. Here’s how.

Worried About Getting Bumped Off Your Next Flight? Know Your Airline Passenger Rights!

Wondering what your options are if you're delayed or bumped off the plane? We've got your airline passenger rights listed here so you'll know what to do.

Bag The Top Cash Back Credit Cards And Earn Free Money

Check out Kiplinger’s best cash back cards to see how you can earn the most free money from your everyday credit card purchases.

Think Outside The Box To Win In Today’s Tight Housing Market

Frustrated by the competition in today’s tight housing market? See how you can get creative and make your offer stand out.

The New Love Deal: What You Must Know Before Marrying, Moving In, And Moving On

Afraid of discussing finances with your partner? Dive into “The New Love Deal” and have one less thing to stress about in your relationship.

What To Do If Your Neighbor's Airbnb Starts Spinning Out Of Control

What do you do if the Airbnb guests start jumping off the roof into the pool and start strewing beer cans and trash all over the yard?

Confessions Of A Recovering Car Dealer

You’re no match for the slick car dealer. Level the playing field and get the inside scoop on how to get the best deal for the car you want.

Are You A Shopaholic? Know The Signs, Break The Habit

Retail therapy: It feels so good, but it’s a habit that can destroy your financial health. Here's everything you need to know about being a shopaholic.

Cuba Rising: The Journey From Poverty To Plenty

See Cuba from the eyes of this Cuban-born US politician, as he takes us though the beginning stages of Cuba's great awakening.

4 Tips To Buy Stocks Low

Steve shows you the tried-and-true methods to buy stocks low in the style of Warren Buffett.

How To Build Wealth Through Investing And Become The Invisible Millionaire Next Door

Believe it or not, all you need to build wealth through investing is a steady job, the right mindset, and some discipline.

5 Parallels Between Poker And Investing

While gambling in the stock market is often disastrous, even Warren Buffett knows when to hold them and when to fold them.

Predict And Profit From Demographic Shifts

Turns out you can predict the next big trend and profit from demographic shifts. This expert tells us how. (Hint: It's almost too easy)...

America’s Affordable Housing Crisis Just Got Worse In 2017

Recent data showed a 7% drop in homes for sale at $100,000 or below, underscoring a worsening of America’s affordable housing crisis.

Amazon To Buy Whole Foods: Now That's Food For Thought!

By now you've heard the headlines "Amazon To Buy Whole Foods". We look at what the future of shopping may look like.

Understanding The Great Depression May Explain Trump's Impact

Understanding the Great Depression provides valuable insights on whether Trump’s America First stance might cause economic turmoil in the years ahead.

Will The 2017 Market Rally Continue Through The Rest Of The Year?

We're in the second longest bull market since World War II. Many fear that this sustained 2017 market rally could end soon, so we took an in-depth look.

It’s a Seller’s Market for Now, But Things Could "Flip"

We are in a seller’s market now, subject to change over the next few years. Here's a look at when things might flip over to a buyer’s market.

Keys To Success For A Life Of Passion And Purpose

These techniques can lead to a more productive personal and professional life. The keys to success are as relevant for men as they are for women.

What America's $1.4 Trillion Student Loan Crisis Means To You

America faces a student loan crisis, with $1.4 trillion in outstanding educational loans. Here's what you can do to tame the beast.

Congress Is Going To Change The Affordable Care Act. Are You Ready?

Republicans have vowed to make changes to the Affordable Care Act. Here's how their key provisions will impact Americans of all ages.

How To Think About Money: Here's A Blueprint For Your Financial Affairs

Jonathan Clements discusses his latest book, How to Think About Money, focusing on harmonizing all aspects of your personal finances.

Increase In Fannie Mae's Debt To Income Ceiling Should Make Your Next House Easier To Buy

Fannie Mae raised its debt to income ceiling which might boost affordability and home purchases in this hot housing market.

Do I Have Enough For Retirement?

As Bob Dylan, our recent surprise Nobel Laureate once said famously in song… “the times, they are a ‘changin…”There was a time when working hard and following the rules almost certainly guaranteed a comfortable retirement, but that very American dream of a blissful retirement, free of financial worries, appears to be slipping away for more and more Americans—especially those who “don’t follow the rules.” What I mean by “rules” are simple things such as making a budget, managing expenses, consistent saving and investing, keeping track of your job-related benefits, and sticking to your plan.Do I have enough for retirement?Today, most U.S. households are heading for a worse lifestyle and quality of life in retirement than they enjoyed while they were working, despite bringing in reasonably good paychecks, and this is—woefully—because they simply aren't saving enough. Thirty-five percent of U.S. households in their prime earning years have nothing saved in a retirement account and no access to a traditional pension plan, according to an analysis from the Federal Reserve.Among households that do have some savings, the typical amount is $73,200; that's about 15 months of the median household's income. The only group that doesn't have to worry as much are the richest 10% of households that have more than $400,000 in retirement accounts.The low retirement balances mean the majority of households — 52% — are at risk of having to cut their spending after entering retirement.Make a retirement plan and stick to it.So, for most Americans, things don’t look that good, which is a pity because I believe the American Dream is still achievable by most Americans if they just get their basic financial planning in order and stick diligently to a plan. And let me add this: I’ve been a practicing financial advisor for 35 years, and I have seen many success stories—people with modest jobs and paychecks who, through wise financial planning early in life, conservative spending, and prudent investing are now millionaires.These people are positioned to live a rich lifestyle in retirement, free of financial worry, with tremendous peace of mind, and more money in the bank than they’ll likely need. That’s what I want for all of you. So, you see, the problem isn’t that Americans aren’t making enough; it’s that they aren’t being diligent enough about retirement savings.In light of our recent election, let me also say that this retirement anxiety stretches across political affiliations. Nearly equal percentages of Democrats and Republicans say they're not managing their retirement planning very well.It’s not your fault, but it is your responsibility.That said, the fault doesn’t wholly lie with American taxpayers. This looming retirement crisis is also the result of a system that has increasingly put workers in charge of saving for and managing their own retirements. Data shows that the top 10% of U.S. households made more than $162,000 last year—up 6% from a decade earlier, after adjusting for inflation. For middle-class Americans, incomes have barely stayed ahead of inflation, while lower-income households are now making less than they were a decade ago.With traditional pensions plans increasingly becoming extinct, it's even more important for Americans to save on their own. Meanwhile, Social Security—the last line of defense for many people’s retirement plans—is barely going to be enough to support you as you age.To help close the gap, states are trying their own measures. California recently passed a law requiring employers to automatically enroll their workers in a state-run retirement savings program by deducting money from each paycheck, and early results are very encouraging.The bottom line is the onus still lies on you. Making these important changes in your financial life can make all this retirement pain avoidable.

Yes…Luxury Investments Are Losing Their Luster

The economy is firing on all cylinders, but why are luxury investments fading? Here's how the decline will affect you even if you're not invested.

How Bettin' On The Ponies Equates To Successful Investing

Here's how investors can boost their successful investing returns by studying what it takes to win at the racetrack.

How Technology Has Impacted The Music Business

Technology has impacted the music business in almost every aspect. Here's how new artists can still break through and make a name for themselves.

What Seniors Must Know About Long Term Care

There’s a 70% chance that someone over the age of 65 will need some form of home care but it doesn’t come cheap. Here's how to budget for it just in case.

Why Are Millennials Buying Homes Rather Than Renting Them?